There are many different options to improve a token’s availability and accessibility on the current market. All of them are quite different, and today we cover the two main options; listing on Centralized Exchanges and Decentralized Exchanges, the benefits and risks attached to them, and some generic requirements to make those listings, if any, successful.

Centralised Public Exchanges

Public exchanges are regarded as the to-go option by the blockchain market to improve token accessibility. While it is proven to be an efficient path to improve accessibility and potentially the valuation of a token, it is also increasingly viewed as a very speculative route.

For example earlier this year, The Internet Computer (ICP) launched on many exchanges and despite their incredible marketing efforts, the value of their token dropped by 95% since launch. See: https://www.coindesk.com/dfinity-icp-token-down.

As of today, we would consider listing TFT on centralized exchanges if a given set of pre-requisites would be met to ensure a healthy strategy. Listing on a centralised exchange can be seen as a necessity, but it comes with its own pitfalls for the community. Most exchanges are seen as intransparent and come with their own security risks. There are a lot of reports of washtrading and unfair practices from centralised exchanges.

“In a way, public exchanges have a lot of similarities to casinos, the average person does not understand how it works and many make mistakes and lose asset value. The game is led by large market makers that make the money based on advanced knowledge, insider news and AI driven trading bots. The house never loses.”

The main advantage in listing TFT on a centralized exchange, as it provides many convenient financial gateways for the community and new adopters. In so doing, we will consider listing on top 5 exchanges, but only if a given set of criteria is met. They are vital to sustain a healthy token price valuation and growth after listing:

Financial backing from investors and/or community for liquidity providing: to give you an idea, listing on a major exchange can cost up-to U.S $1,000,000 and several more millions would be needed to ensure liquidity

Proportional growth of the community: to provide more organic demand and supply on exchanges - this should happen naturally with more farmers and users on the ThreeFold Grid.

Support from Exchange in regards to Marketing: with token listing announcements and supported joint marketing.

There are potential risks related to pump and dump communities and bot trading that very quickly take advantage of rising crypto assets on major exchanges. In summary, if ever we would bring TFT to a centralized exchange, it would require careful consideration and organisation to mitigate these risks.

Considering the sums required to list TFT on top exchanges, and the risks associated to it, we believe that there are better ways to invest current funds. For example, the further development of our technology and growth of the ecosystem, which should naturally drive the utilization of the ThreeFold Grid.

If you are representative of an exchange and would like to list TFT without a fee, we always remain open to consider such opportunities. Thank you for reaching out to us here.

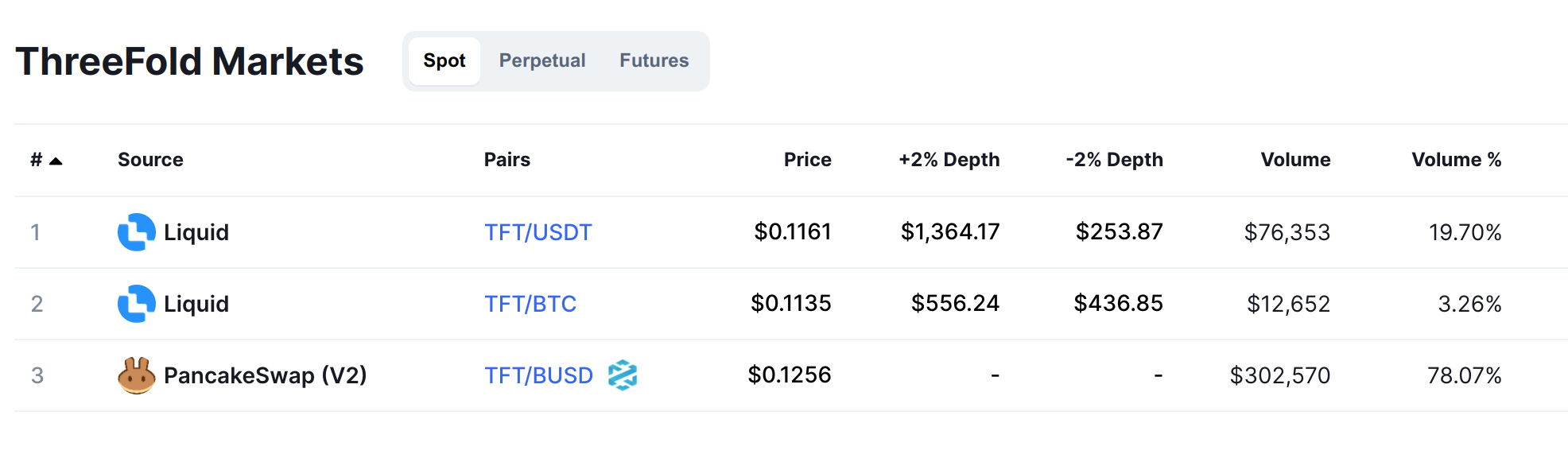

Decentralized Exchanges (DEXs)

We believe that DEXs provide a more fair, secure and convenient ground for token liquidity. DEXs are transparent, and with their proven liquidity pool mechanisms they offer more stable (less volatile) token prices. We consider this as a more preferable route for token accessibility improvement while some of the risks similar to Centralized Exchanges still apply.

They are generally free to list (no listing fees, only development efforts for the integration required), but there is increased demand to provide liquidity compared to the centralised exchanges. Therefore, we would still have to meet the same necessary criteria listed for centralized exchanges before going to a new DEX to ensure a healthy strategy for more accessible and available TFT across the world.

Be sure that the ThreeFold Team will inform the community regarding potential developments and upcoming listings. If you want to support this process financially or by some other means, please let us know.