Hi,

In this post I would like to explain how the current level of liquidity for the ThreeFold Token (TFT) is connected with the current low price of TFT, and how quickly this can change.

Please note, TFT should not be seen an investment instrument. Its main purpose is to buy and sell IT capacity on ThreeFold Grid. Therefore, the value of the token ultimately should be in direct correlation with the supply and demand of IT capacity, and liqudity should be in direct correlation with capacity reservation volumes. Of course, there is also the speculation element on the market but this factor is quite volatile and subject to market sentiments.

Right now the grid is already quite big, with 70+ PB of storage and 16k+ cores online. The fact is that current utilisation is low and with TF Grid 3.0, we expect to see much more utilization. In this way it creates a disbalance between supply and demand for the token. In the future, the growth of demand will definitely affect value of the token.

As for liquidity, it is also quite low at the moment, which has a major impact on the price of the token and means it is not very representative of its actual value. Buying a substantial amount of tokens at the current market price is not possible. Due to low liquidity, the price will start to grow quite quickly.

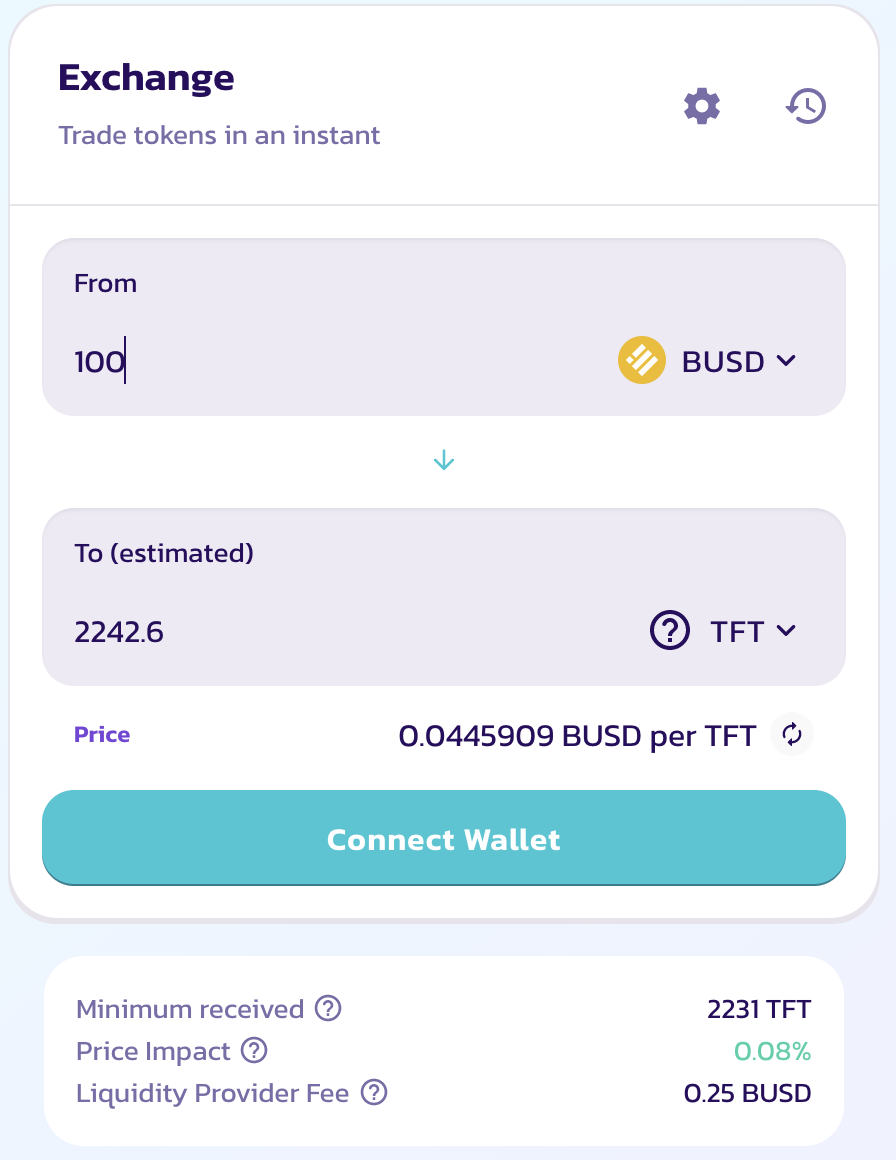

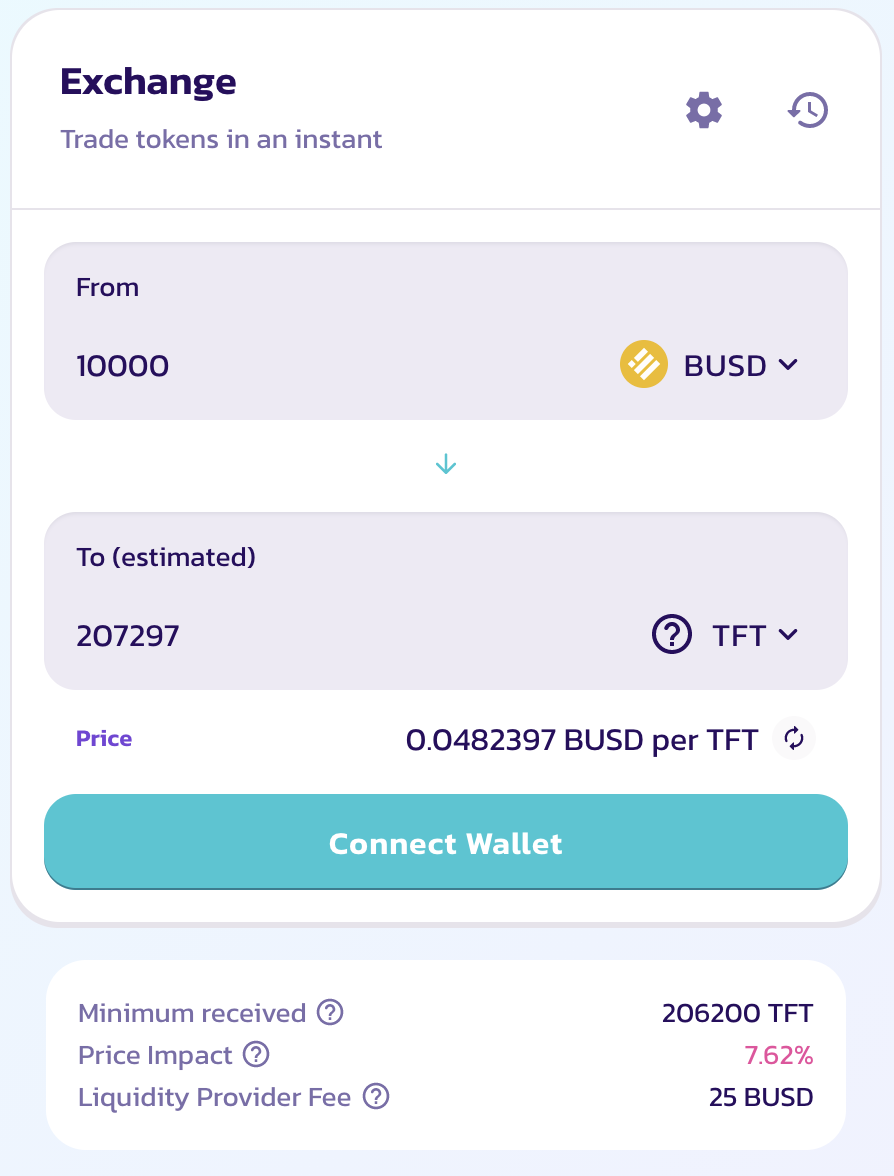

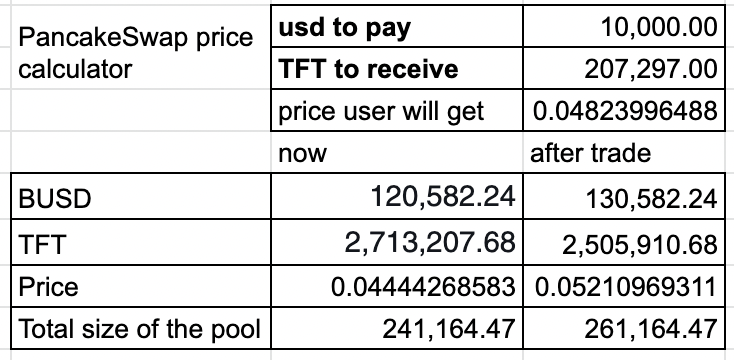

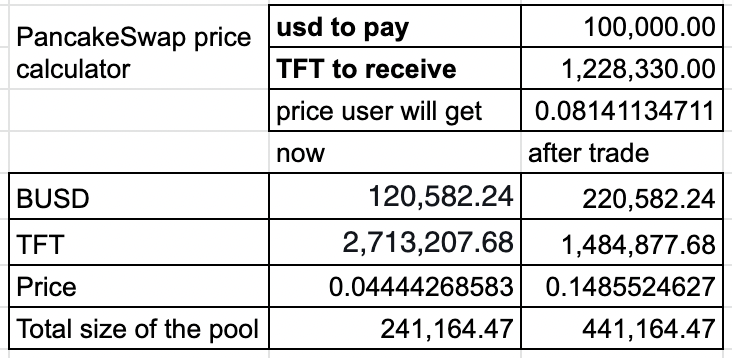

In order to demonstrate the current level of liquidity and its effect on the price of TFT, let’s take a look at PancakeSwap:

At the time of writing this post, if you were to you buy 100 USD worth of TFT, you would get it at 0.0445 USD per TFT. However, if you wanted to buy 10,000 USD worth of TFT, you would get it at 0.048 USD per TFT.

And it is interesting to note, that this purchase would rise the base price to 0.052 USD per TFT for the next purchaser.

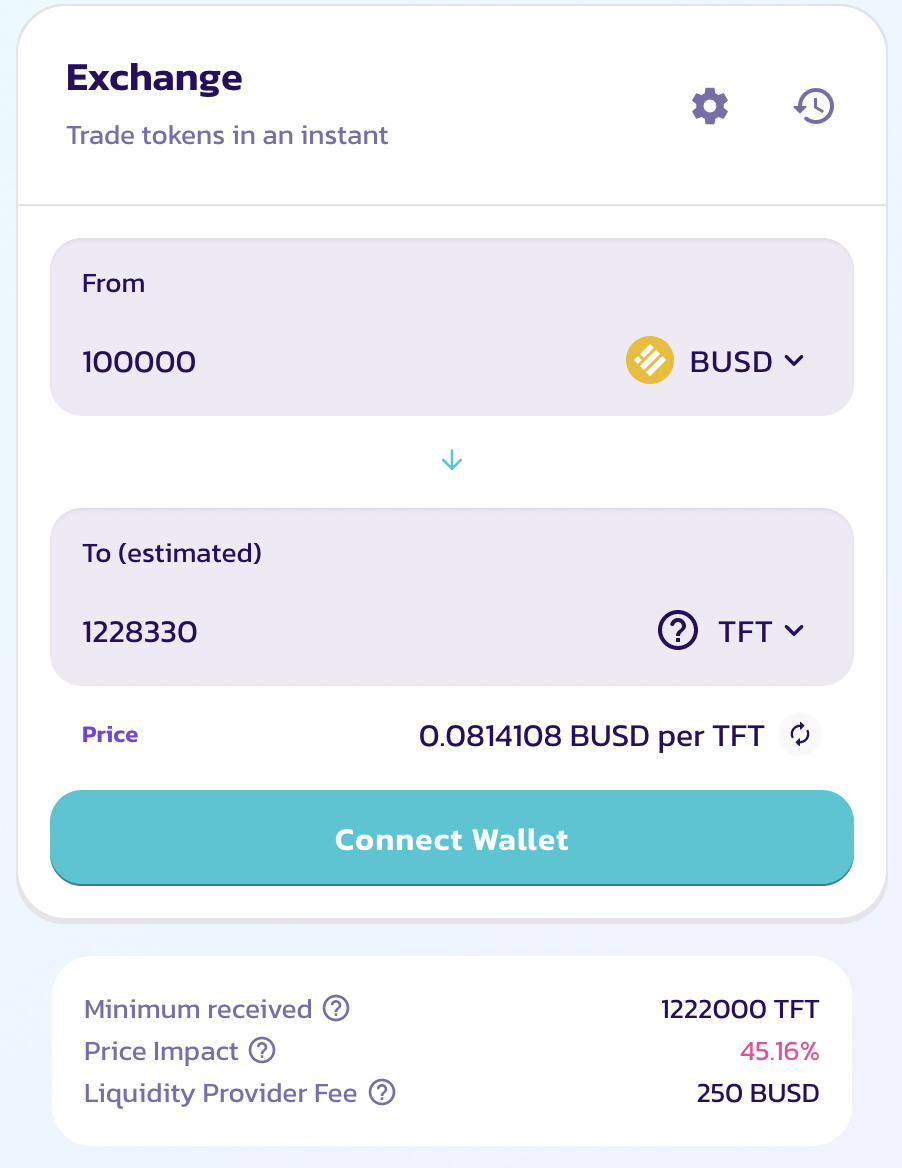

If someone would decide to purchase 100,000 USD worth of TFT, the average price would then be 0.081 USD per TFT.

And for the next purchaser the base price would rise up to 0.148 USD per TFT. Similarly, the value of the PancakeSwap liquidity pool would rise to 440k total without additional liquidity deposits, only because of price fluctuations.

In this way we can see that the current TFT price is not very representative of its actual value, for now. Exact numbers may vary depending on what is the current price, but the principle is the same. As utilisation and liquidity grows (take a look at our plan for utilisation), this would probably change. Growth of the utilisation-related demand will create a ground for the more stable and more liquid tokenomics.

, if you have any ideas and want to participate in this, please ping me in

, if you have any ideas and want to participate in this, please ping me in