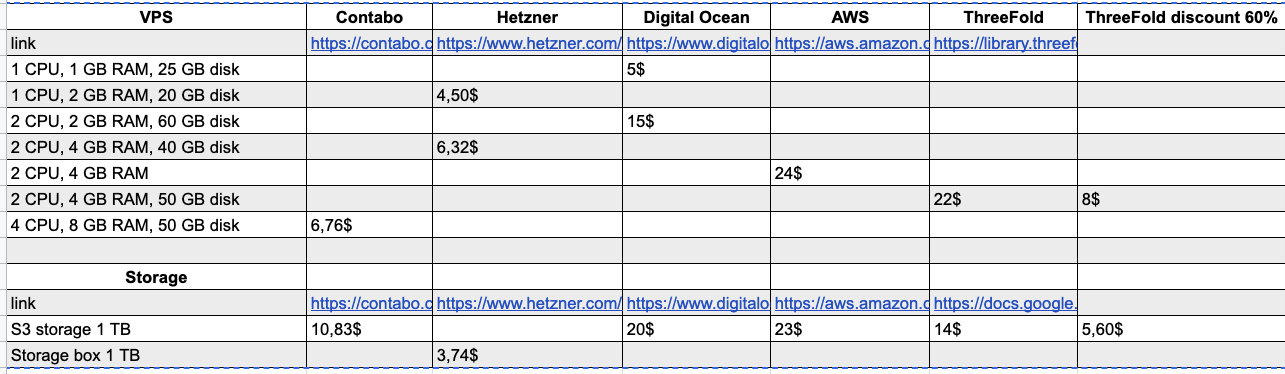

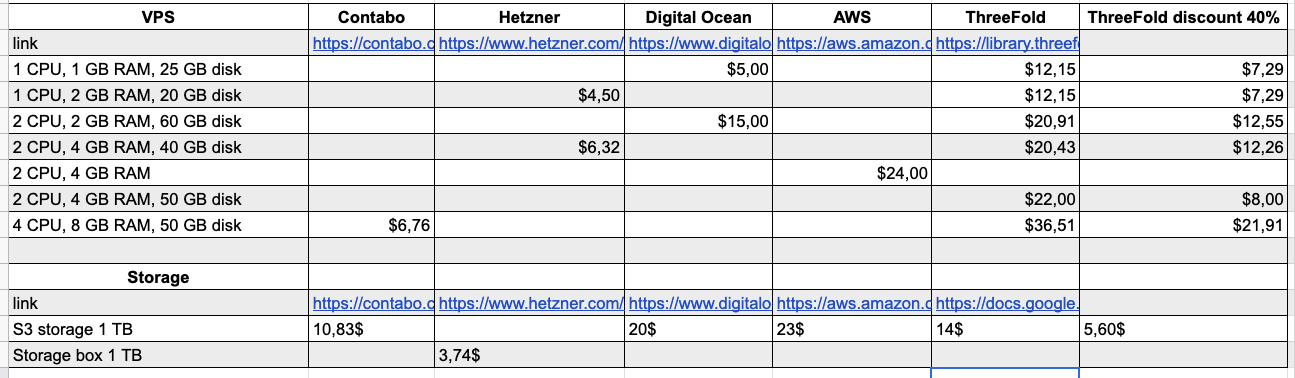

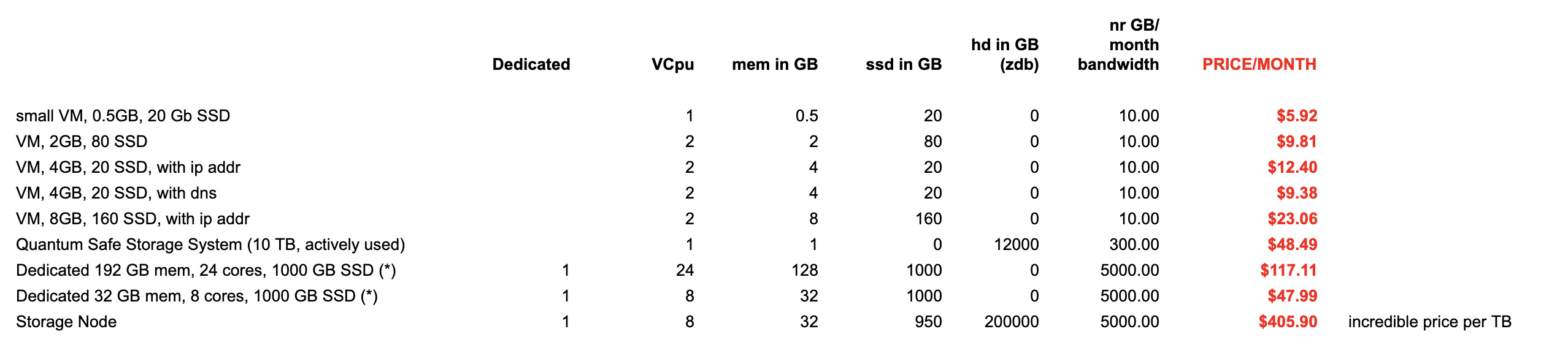

Even the storage price is high, especially before discount. Wasabi offers 1TB for $5.99 per month, with discounts for longer contracts.

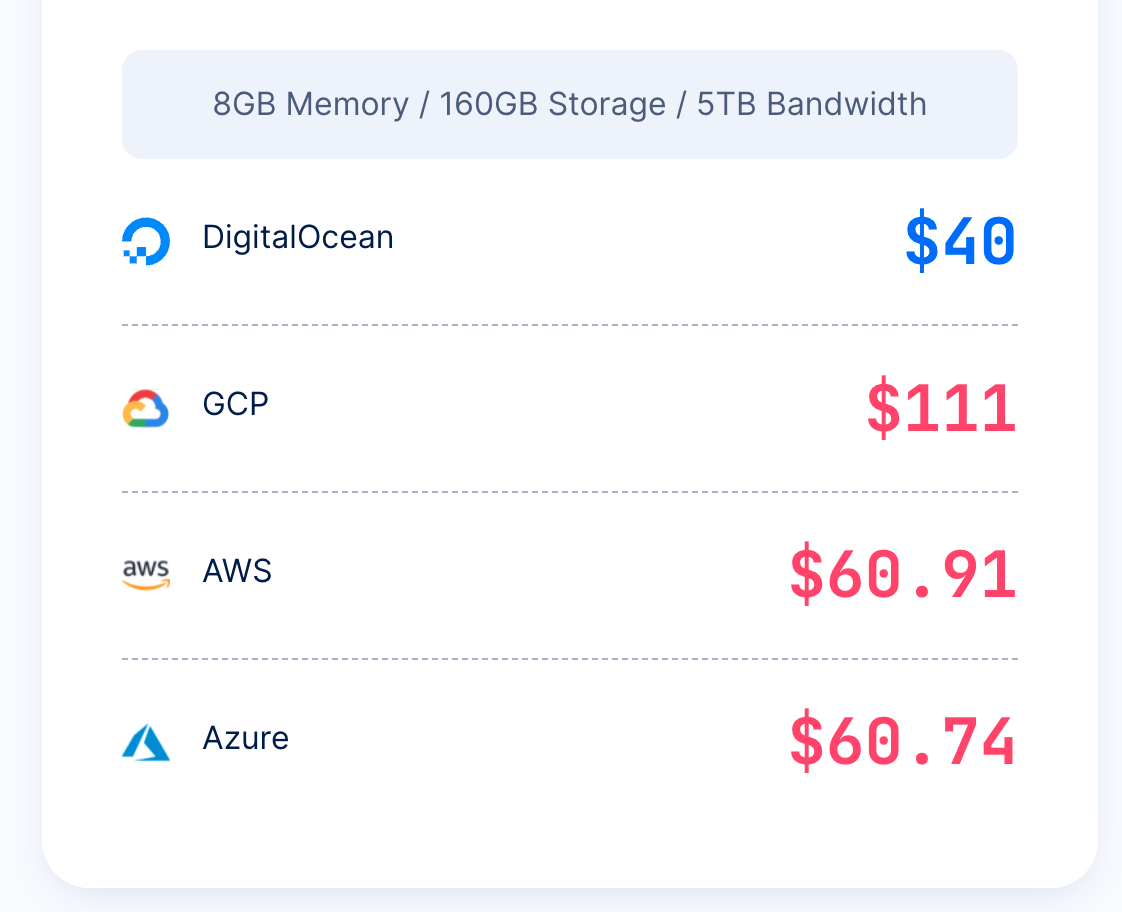

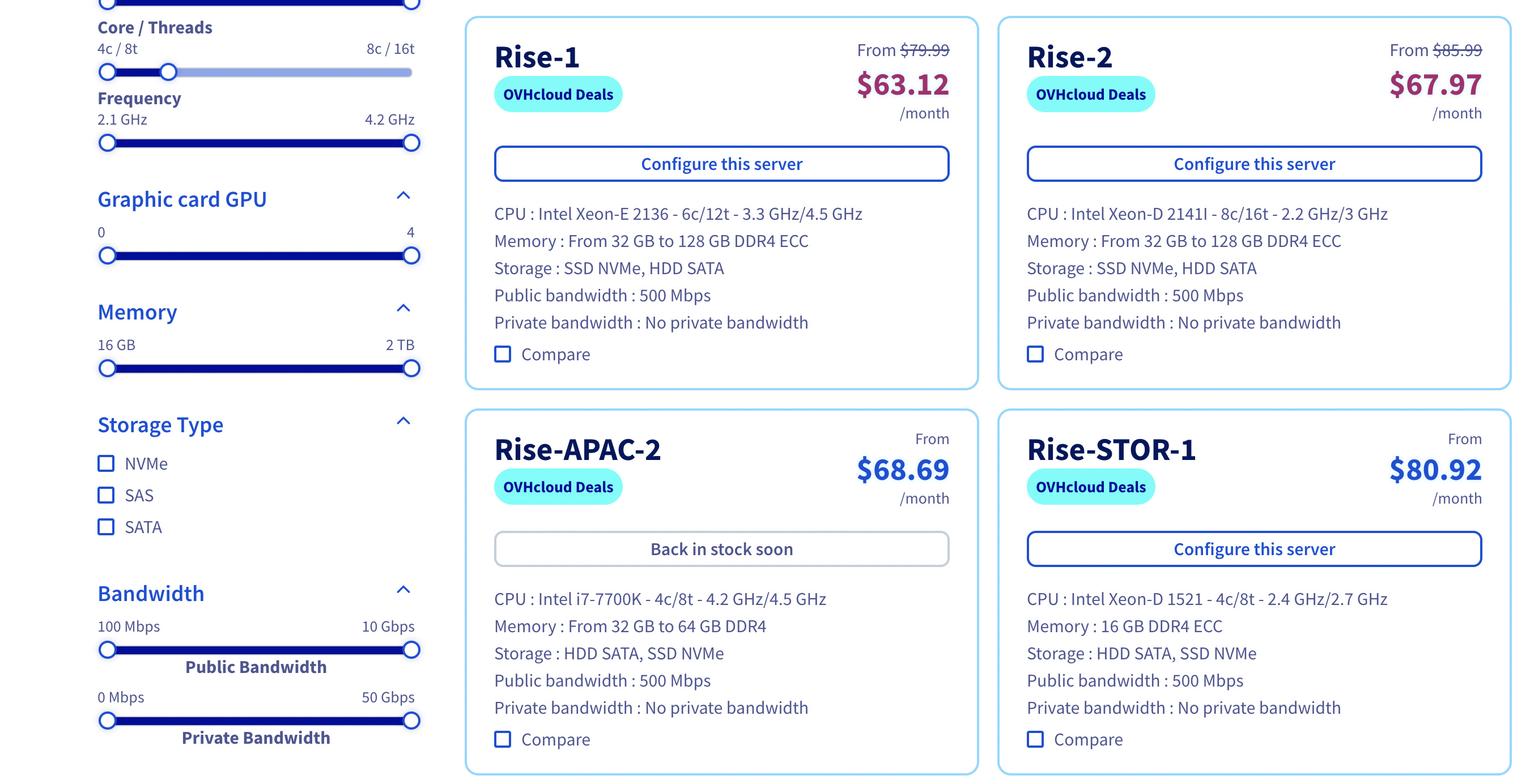

I agree, it’s problematic to compare TF discounted rates with other providers pay as you go rates, especially when the other providers also offer discounts when capacity is prepaid.

Whether or not we should even be comparing these directly from a quality/SLA perspective is a larger question. For now, I think we can at least agree that the Grid is a new technology which still needs to earn its trust. Setting a really competitive price, at least to start, is a great way to attract usage and build that trust.

There is a simple reason for a higher fee in this direction, which is to cover the gas cost on BSC. In the other direction, the user has already covered the gas fee and all that remains is a tiny fee on Stellar. That said, I agree that 50 TFT is too high relative to typical gas costs. The devs do have a proposal to scale this based on actual current gas price.

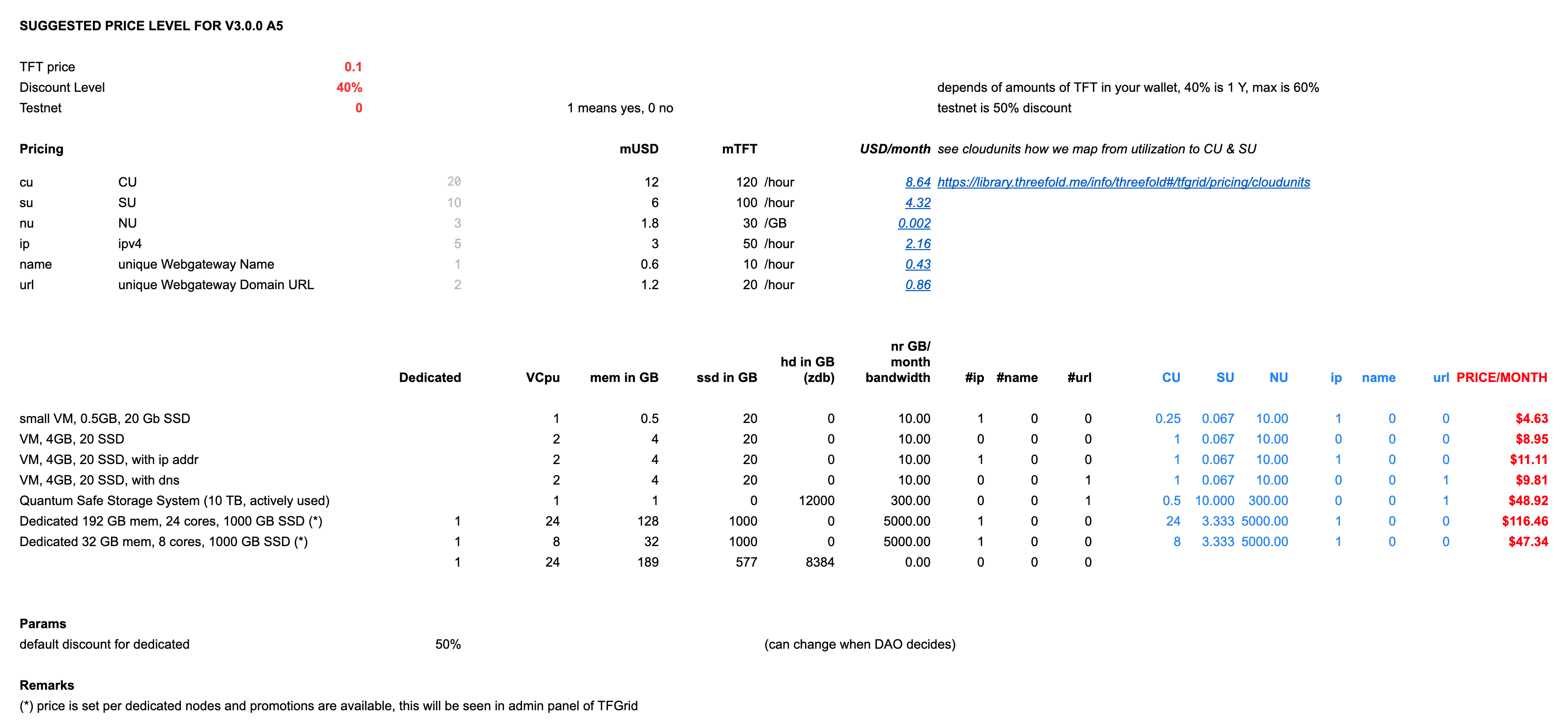

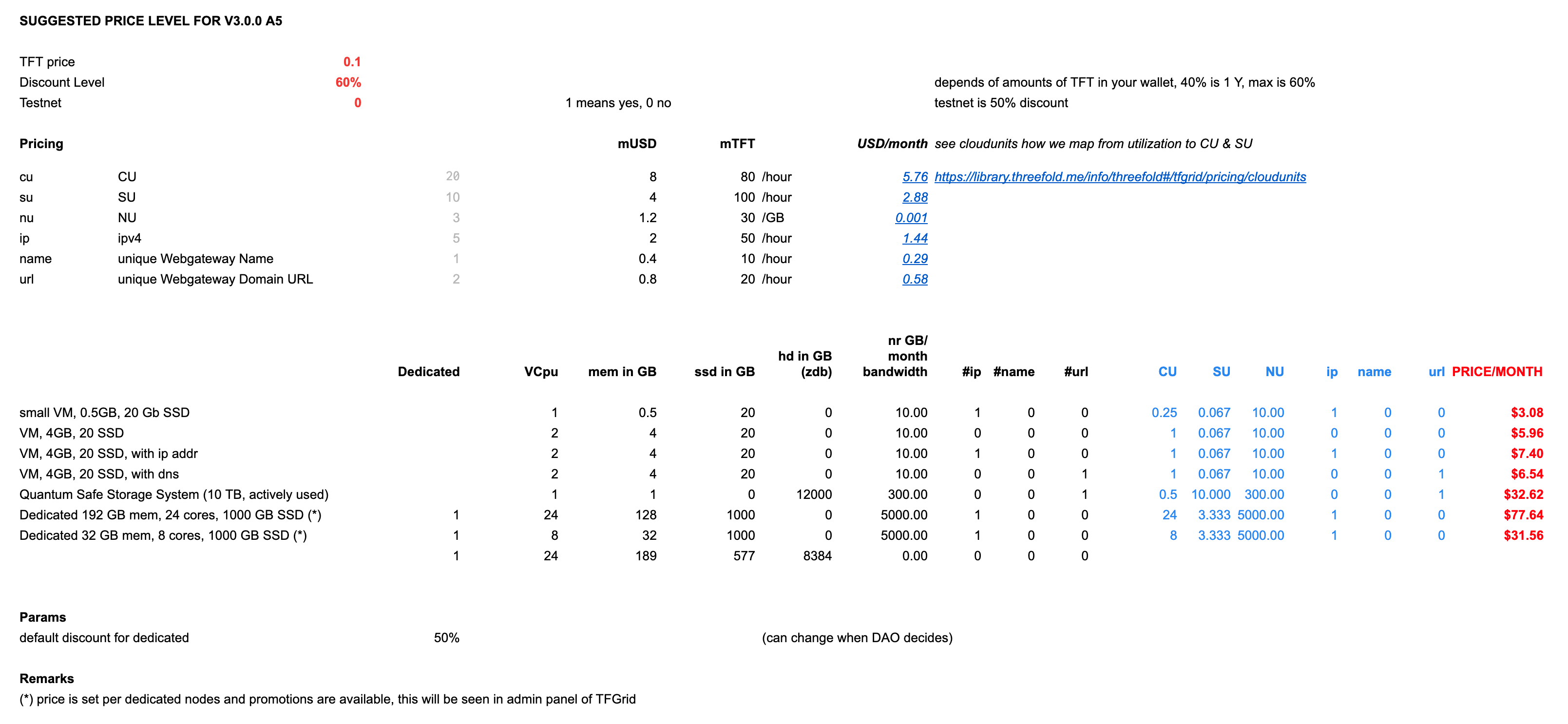

Just to be clear, the capacity pricing is always dollar denominated, based on a (currently manually coded) TFT price. So far that’s always been $.1, meaning that there’s such a discount as you’re suggesting even now.

Looking at historic token price, even seeing it bottom out around $.01 wasn’t a sufficient discount to drive demand for consuming capacity. There’s much more that’s needed, including a nice UX, support, and sufficient testing.

We’re not as vocal about it as farming right now, but we do have ongoing efforts to onboard partners who want to utilize the Grid. Our resources are limited, so most energy is focused on growing the Grid and working out the kinks before too many users arrive. As you’re well aware, there are still very important questions to be answered, like how to handle bad actors on the user side.

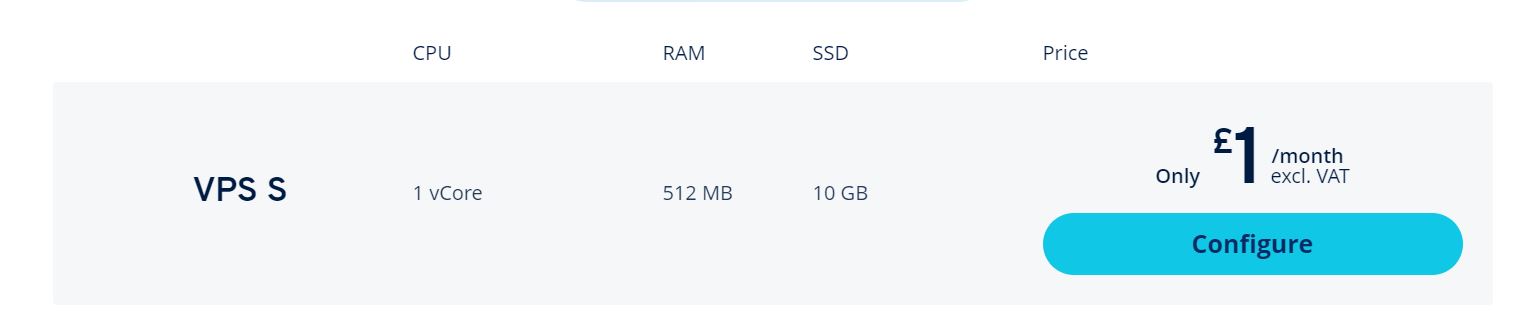

Anyway, I think it’s really productive to hash out attractive dollar denominated prices for Grid capacity, so thanks for your contributions here. As someone who actually uses the Grid constantly, I can say that the current pricing feels high to me, even with the 50% discount on testnet.